Have you ever wondered why the electronic receipt has become the talk of 2025?

It’s no longer just a piece of paper handed to you at checkout; it has transformed into a cornerstone of Egypt’s digital transformation journey.

Imagine every purchase you make being instantly recorded within the e receipt system, giving both you and the merchant a transparent and documented record. This change doesn’t just benefit business owners, who now enjoy smoother accounting and easier sales tracking it also protects consumers by securing their rights and providing official proof of purchase.

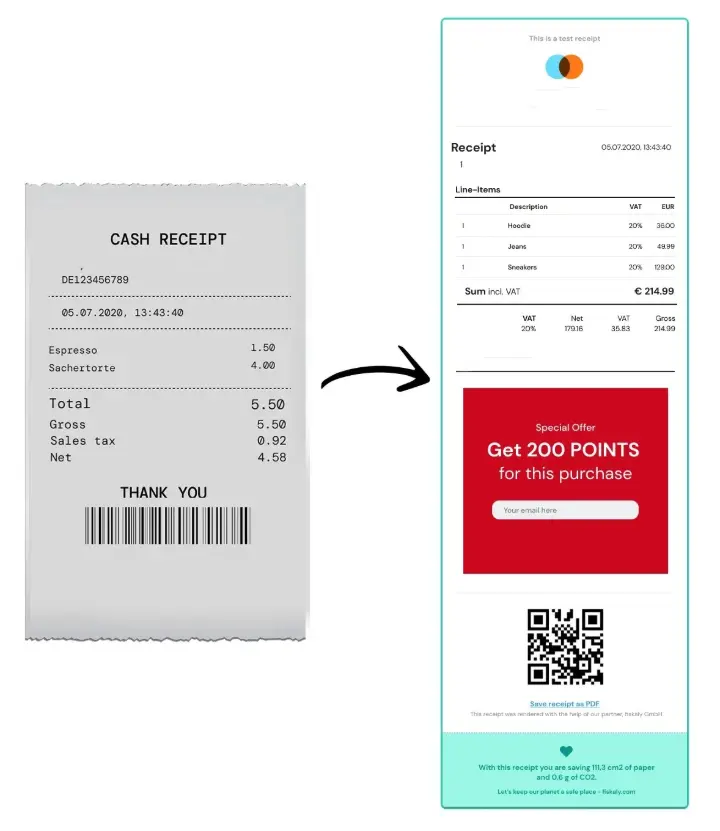

If we look back, invoices and paper receipts used to be the only way to document transactions. With technological progress, however, the e receipt has become clearer, easier to track, and is gradually replacing traditional paper receipts. Today, registering in the e receipt system is essential for every merchant or service provider who wants to keep pace with the future and avoid potential penalties.

This shift is more than just about taxes or accounting. It’s a fully integrated system that strengthens trust, transparency, and speed in every transaction bringing together the benefits of both e tax invoice & e receipt in Egypt’s digital economy.

What is the Electronic Receipt?

After realizing the importance of moving toward the electronic receipt system in 2025, one key question naturally arises: what exactly is the e receipt?

Simply put, the electronic receipt is a digital document issued when a purchase is completed or a service is provided. It is sent directly to the tax authority while the consumer instantly receives a copy that validates the transaction. In other words, it’s a smart and secure alternative to the traditional paper receipt.

Here it’s important to distinguish between the e tax invoice & e receipt:

E tax invoice: mostly used in transactions between companies or large businesses (B2B).

Electronic receipt: issued for direct sales to the end consumer (B2C), such as in restaurants or retail shops.

To make it clearer, let’s look at a few examples:

- Dining at a restaurant? You’ll now receive the electronic receipt instead of the old paper slip.

- Shopping online? Your e receipt will arrive via email or app instantly.

- Paying at the supermarket? The transaction is recorded within the e receipt system, accessible to both the merchant and the consumer.

That’s why registering in the e receipt system is not just a legal requirement, but also a modern tool to protect consumer rights and streamline business operations at the same time.

Why Was the Electronic Receipt System Launched?

After understanding what the electronic receipt is and how it differs from the e tax invoice, it’s time to explore why the state places such great importance on implementing the e receipt system, and what goals are envisioned for 2025.

1. Fighting the informal economy

By linking every sales transaction to an authenticated e receipt format, the system eliminates unrecorded activities that previously caused major economic losses for both the state and society.

2. Simplifying business operations

Merchants no longer need paper books or complicated spreadsheets. Through registering in the e receipt system, every transaction is automatically recorded, organized, and stored in a precise, trackable database.

3. Enhancing transparency between taxpayers and the tax authority

Each electronic receipt becomes an official record showing transaction details instantly, building trust and reducing tax disputes.

4. Building consumer confidence

When customers receive the e receipt, they gain reassurance that their rights are protected and their transaction is officially recognized.

Thus, the objectives of the system go far beyond taxation. They include improving the business environment, strengthening trust, and building a more stable and fair digital economy for everyone.

Who Is Required to Join the Electronic Receipt System in 2025?

After reviewing the goals of the electronic receipt system in 2025, let’s move to a crucial question for every business owner: which companies are required to join, and are there any exemptions?

In fact, the e receipt is considered the next phase of the e tax invoice & e receipt ecosystem, with a stronger focus on businesses that issue receipts directly to end consumers such as retail outlets, quick-service shops, and restaurants. This means all taxpayers dealing directly with the final consumer are obligated to join, though the rollout happens gradually in phases.

Checking if your company is required

It’s simple to find out whether your company is required to join the electronic receipt system. Just visit the inquiry link for obligated taxpayers, enter your tax registration number in the designated field, and you’ll instantly see your company’s compliance status.

Phases of e receipt implementation

- Pilot phase: Not mandatory, aimed at training taxpayers in a simulated environment before official registration.

- Phase One (July 1, 2022): Covered 153 companies.

- Phase Two (October 1, 2022): Covered 400 companies.

- Sharm El-Sheikh Phase (November 1, 2022): Obligated companies located within Sharm El-Sheikh.

- Phase Three (November 15, 2022): Obligated 2,000 companies.

- Phase Four (2023–2024): Covered Greater Cairo and Alexandria, divided into five sub-stages targeting sectors like healthcare, education, restaurants, hotels, gold, furniture, telecom, and services.

- Phase Five (2024–2025): Extended to the remaining governorates, covering the same sectors but with a wider geographical scope.

Important notes

The sectors required to adopt the e receipt system include: healthcare, education, restaurants, hotels, transport, jewelry, furniture, apparel, electronics, insurance, telecom, food products, as well as cultural and entertainment activities, among others.

The only difference between Phases Four and Five is geographical scope: Phase Four targeted Greater Cairo and Alexandria, while Phase Five expanded across the rest of the country.

Therefore, every merchant or service provider must review their status through the inquiry portal and prepare to join at the assigned deadline especially since registering in the e receipt system has now become mandatory for most commercial activities.

What Are the Practical Benefits of the Electronic Receipt System?

After clarifying which companies are required to join and the stages of implementation, many may ask: what is the real benefit of all this effort? The truth is, the electronic receipt system is not just a tax compliance tool it’s a practical solution that benefits everyone: merchants, consumers, and the state.

First: Benefits for merchants

Simplified accounting: No more reliance on paper ledgers or manual entries—every transaction is automatically recorded through the e receipt format.

Avoiding penalties: By registering in the e receipt system, the risk of accounting mistakes or tax violations is greatly reduced.

Better sales management: Merchants can track sales volumes in real time and analyze data for smarter decision-making.

Second: Benefits for consumers

Protecting rights: Receiving the electronic receipt ensures that customer rights are officially safeguarded.

Official proof of purchase: If an issue arises with a product or service, the e receipt serves as a reliable legal reference.

Easier returns: Thanks to the clarity of the e receipt format, product returns or exchanges become simpler and more transparent.

Third: Benefits for the state

Better tax revenue control: Every sale is recorded instantly within the e receipt system, reducing tax evasion.

Increased resources: With a broader tax base, the government can allocate more resources to public services and development.

In short, the system is far more than a regulatory measure. It is a practical solution that strengthens trust, protects rights, and supports the growth of the national economy through e tax invoice & e receipt integration.

What Documents Are Required to Join the Electronic Receipt System?

After outlining the benefits of the electronic receipt system for all parties, we arrive at a practical and essential step: what documents and data does your company need for e receipt registration?

Whether you are required to join according to your scheduled phase or you choose to register voluntarily in advance, you will need to prepare the following documents:

- Company’s tax registration number: the primary reference for dealing with the Tax Authority.

- Copy of the tax card: to verify the company’s tax identity.

- Company’s email and mobile number: for communication and receiving notifications.

- Authorized representative’s name in Arabic and English: the person acting on behalf of the company in the registration process.

- Representative’s email and phone number: to ensure fast communication and official authorization.

- Copy of the representative’s national ID: as official proof of identity for the responsible person handling the registration.

Preparing these documents accurately ensures quick approval of your application and helps your company begin operating with the official e receipt format in line with the goals of the electronic receipt system.

Frequently Asked Questions

After reviewing the required documents for joining the e receipt system, many questions still come to mind for both merchants and consumers. Here are the most common FAQs and their answers:

What is the difference between the e tax invoice & e receipt?

E tax invoice: typically used in business-to-business (B2B) transactions.

Electronic receipt (e receipt): issued for direct sales to the final consumer (B2C), such as restaurants, retail stores, or supermarkets.

Is every merchant required to comply?

Yes. All taxpayers dealing with end consumers are obligated to join, but implementation is rolled out in phases. It is crucial to monitor the Tax Authority’s website or use the inquiry service for e receipt registration.

What are the penalties for non-compliance?

Failure to comply may result in financial fines or legal action against the business. It is always best to complete electronic receipt registration once your company is officially mandated.

Can I still keep a paper copy?

Yes. Merchants can print a paper copy for internal use or provide it to customers upon request. However, the only official and recognized proof is the electronic receipt format generated by the system.

With everything we’ve covered about the electronic receipt system its definition, objectives, phases, and benefits it’s clear that this step is not just an update in accounting methods. It is a strategic transformation that reflects Egypt’s ambition toward a fully digital economy.

Collaboration between merchants and consumers is the key to making this system a success. When merchants issue the e receipt, they not only protect themselves from penalties but also build consumer trust and transparency. Meanwhile, consumers should claim their right to receive the official electronic receipt format as part of a new culture that enhances fairness and protects rights.

This transformation aligns with Egypt’s Vision 2030, which places digital transformation at the core of its development strategy making the economy more efficient and public resources more sustainable. Discover U Analyst Software Development Services for 2025.

To help companies adapt smoothly, modern solutions like U-Analyst play a vital role. Already a leading platform supporting the e tax invoice, it also integrates seamlessly with e receipt registration, simplifying company operations and boosting efficiency.

In the end, the system is not merely a legal obligation. It is a real opportunity to build mutual trust and a cornerstone for a stronger, more transparent economic future powered by e tax invoice & e receipt integration.